us exit tax calculation

The increase in the value of their principal residence located outside the United States 2. The Exit Tax calculates the tax the and makes you pay that tax as the price of relinquishing US.

2021 Estate Income Tax Calculator Rates

For Green Card Holders and US.

. It will be as though you had sold all of your assets and the gain generated was viewed as taxable income. The threshold amount for expatriations is 2017 is 162000 and it is indexed for inflation. The exit tax and the inheritance tax Both may be triggered upon abandonment of citizenship or for non-citizens abandonment of a green card by a long-term resident.

877A of the Internal Revenue Code Tax Responsibilities of Expatriation. The Green Card Exit Tax 8 Years analysis is comprehensive. The CPA was asked to calculate the Exit Tax based on the following scenario.

The Exit Tax is computed as if you sold all your assets on the day before you expatriated and had to report the gain. In this first of our two-part series. With the introduction of FATCA Reporting increased aggressive enforcement Foreign Accounts.

Currently net capital gains can be taxed as high as 238 including the net. Then you are taxed on the gains. In some cases you can be taxed up to 30 of your total net worth.

Who then renounce US. The exit tax rules apply to citizens and Legal Permanent Residents Green-Card Holders who qualify as LTR Long-Term Residents. The exit tax calculation.

If a Green Card Holder has been a permanent resident for at least 8 of the past 15 years they become subject to expatriation tax laws as well. To put this simply if you held your Green Card for a. This is the net tax liability test.

The second way to become a covered expatriate is to have a high-enough average net income tax liability for the five tax years before the year of expatriation. The exit tax process measures income tax not yet paid and delivers a final tax bill. For Green Card holders to be subject to the exit tax they must have been a lawful permanent resident of the Unites States in at least 8 taxable years during a period of 15 taxable years ending with the taxable year during which the expatriation occurs when you give back your green card.

Your average annual net income tax for the 5 years ending before the date of expatriation or termination of residency is more than a specified amount that is adjusted for inflation 162000 for 2017 165000 for 2018 168000 for 2019 and 171000 for 2020. In fact it does not even require that the green card holder was a permanent resident for the full 8-years or that they resided within the US. Citizens who expatriate in 2020 there may be IRS exit tax consequences.

If the home qualifies as the principal residence and other requirements are satisfied the taxpayer may exclude up to US250000 500000 for joint returns of taxable gain from income. January 10 2022. Note that you are required to pay the Exit Tax without having realized any income to pay the tax.

This theory is expressed in S. If you are covered then you will trigger the green card exit tax when you renounce your status. This final return is often referred to as the departure return.

Citizenship or long-term residency by non-citizens may trigger US. It applies to individuals who meet certain thresholds for annual income net worth. Citizenship will have to pay the United States a tax based on.

My earlier blog post discussed the rules that apply to a US taxpayer who sells his personal residence whether located abroad or in the US. The expatriation tax consists of two components. A person not excepted under either the dual-citizen or the age 18½ provision will thus need to take inventory of his or her assets in addition to assessing whether the tax-liability test has been met to assess exposure to the exit tax.

When an individual taxpayer emigrates from and permanently severs ties with Canada such that the individual will be considered a non-resident for income tax purposes they will be required to calculate a departure tax on their final personal income tax return. I dont have a. The Exit Tax itself is computed as if you sold all of your worldwide assets on the day before you expatriated.

In the context of US personal tax law expatriation tax also known as exit tax is a tax filing procedure that needs to be completed by some individuals who give up their US citizenship or green card. Note that the persons assets do exceed the 2000000 dollar US. Paying exit tax ensures your taxes are settled when you cease to be a US tax resident.

Renouncing Us Citizenship Expat Tax Professionals

What Are The Us Exit Tax Requirements New 2022

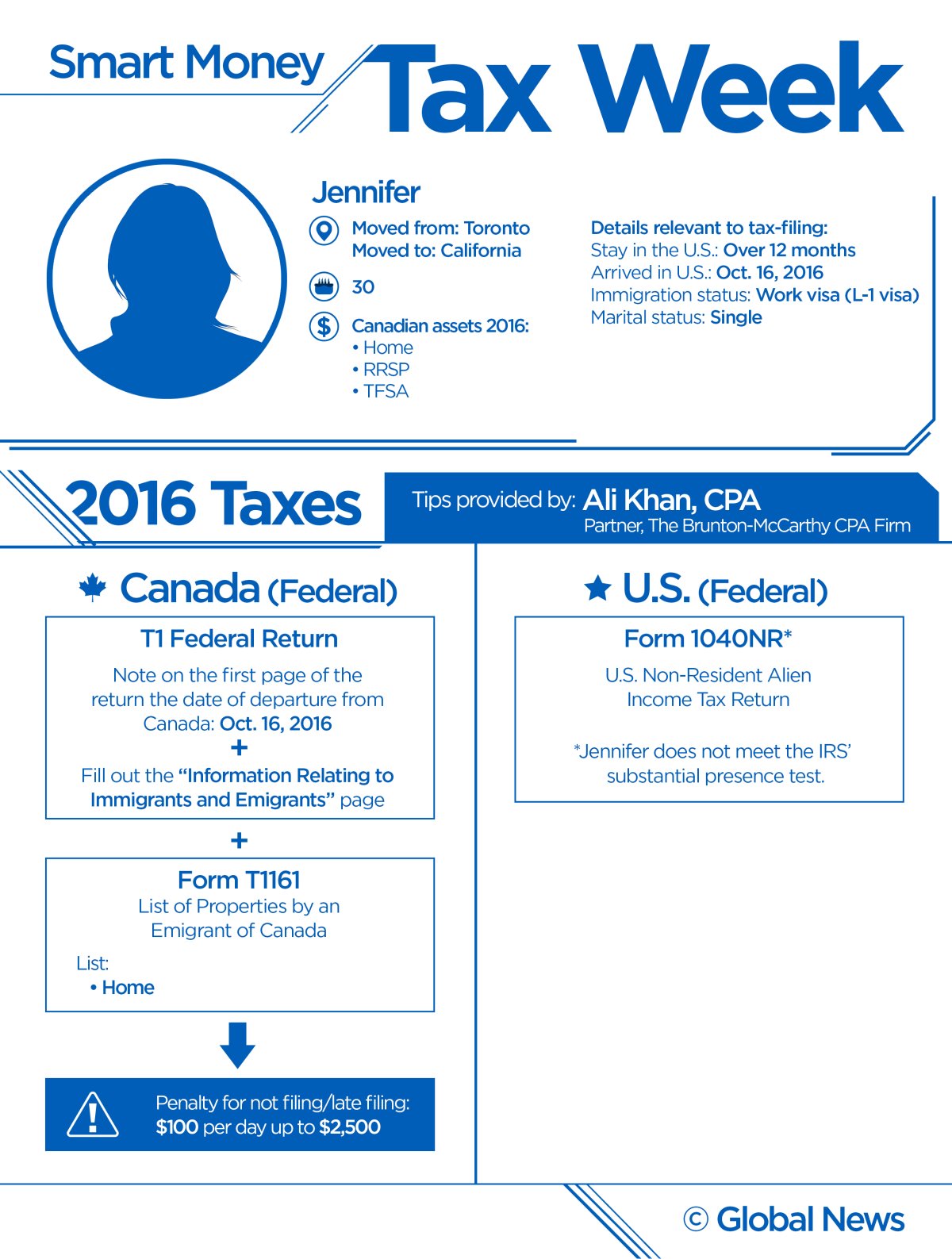

Moving Abroad Mistakes On Your Tax Return Could Wipe Out Your Savings Globalnews Ca

Green Card Exit Tax Abandonment After 8 Years

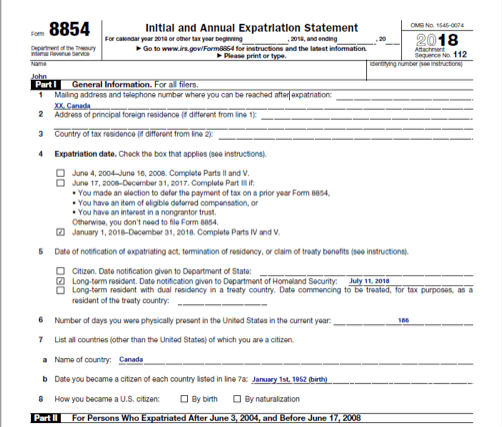

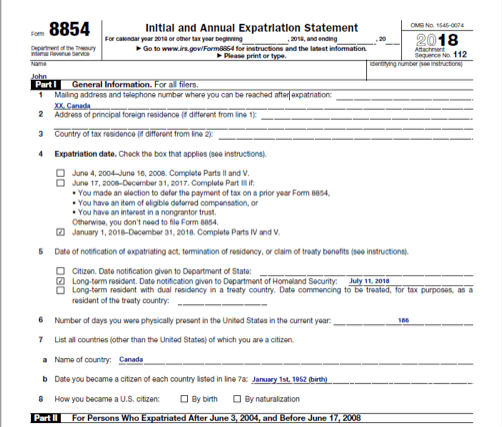

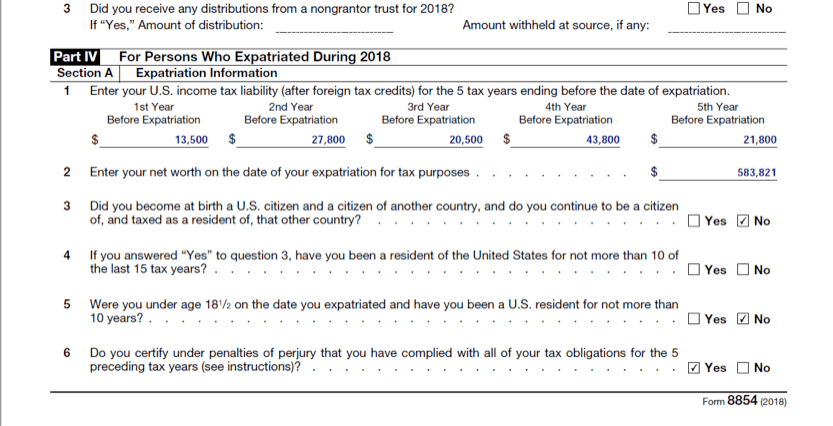

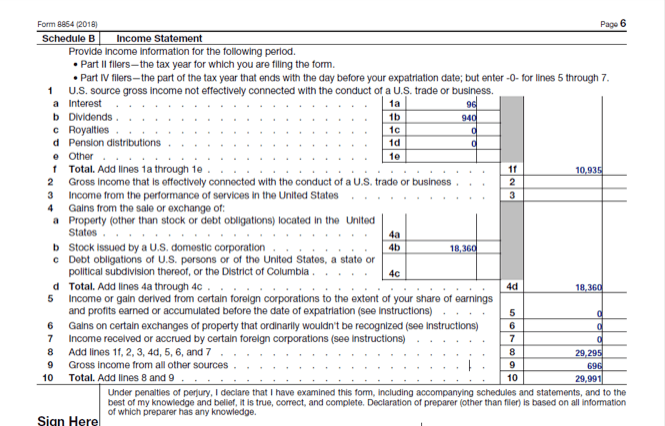

What Is Form 8854 The Initial And Annual Expatriation Statement

Green Card Holder Exit Tax 8 Year Abandonment Rule New

Exit Tax For Renouncing U S Citizenship Or Green Card H R Block

What Are The Us Exit Tax Requirements New 2022

Beware Exit Tax Usa Giving Up Your Green Card Or Us Citizenship Can Be Costly

Renounce U S Here S How Irs Computes Exit Tax

Exit Tax In The Us Everything You Need To Know If You Re Moving

When Might Renouncing Us Citizenship Make Sense From A Tax Point Of View

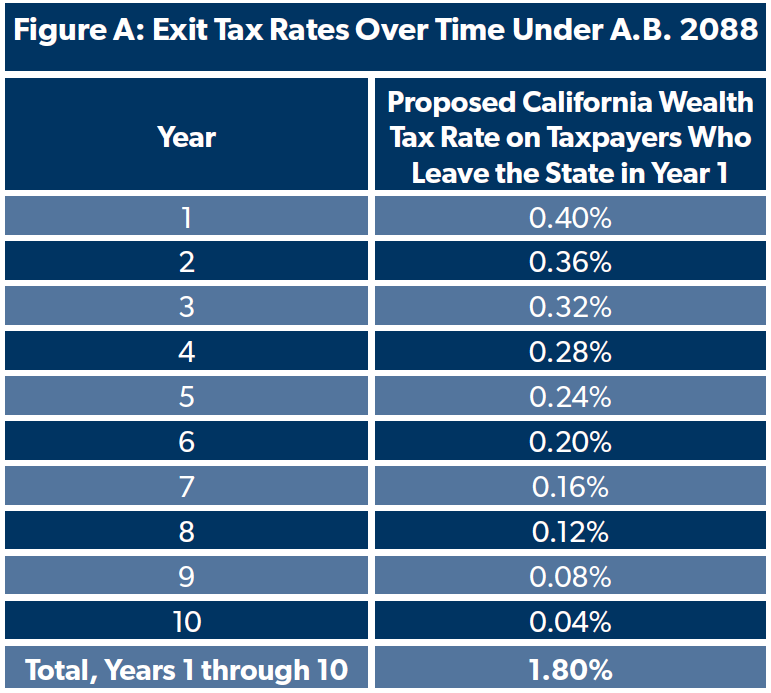

California Wealth And Exit Tax Would Be An Unconstitutional Disaster Foundation National Taxpayers Union

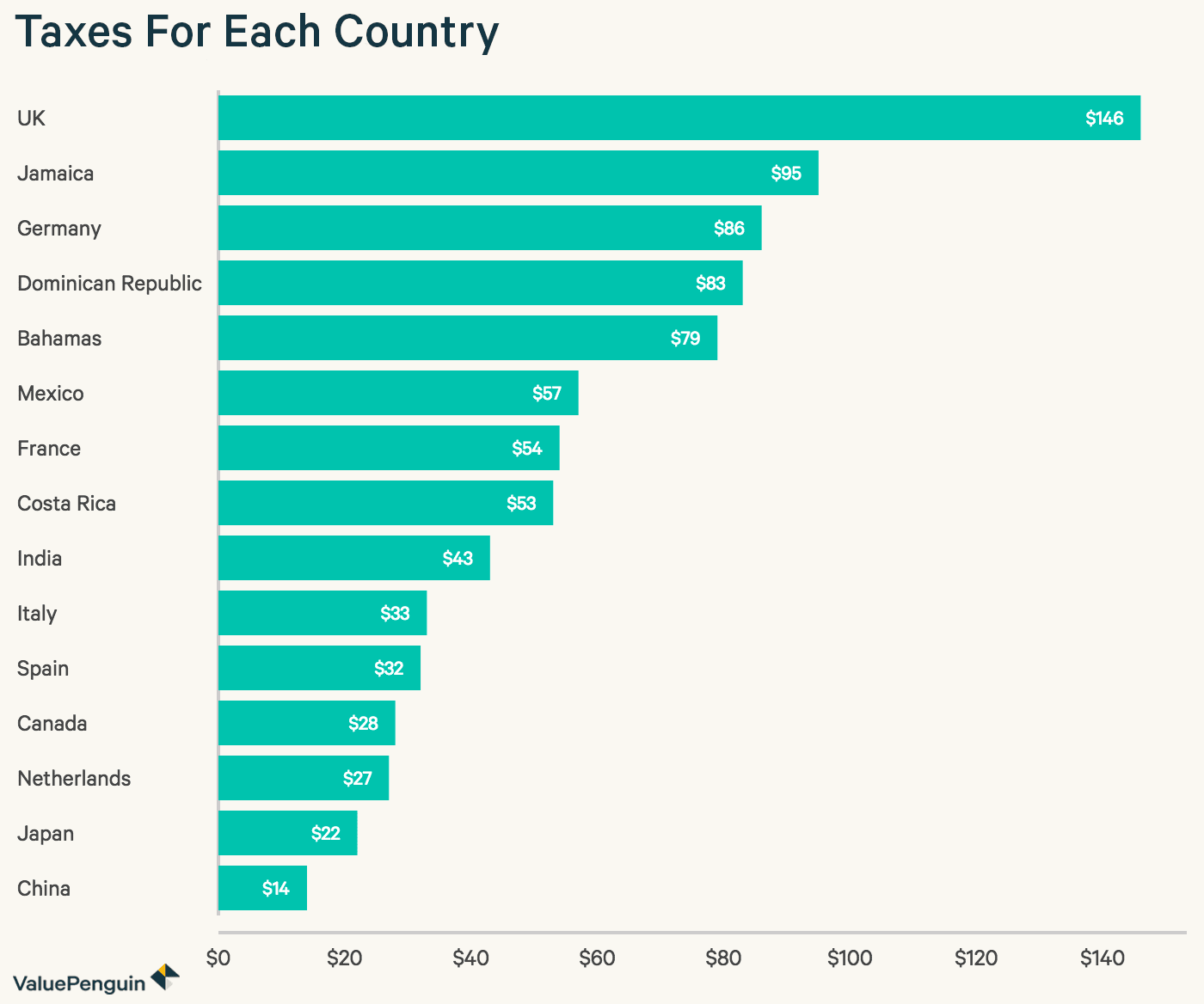

The Taxes That Raise Your International Airfare Valuepenguin

What Is Form 8854 The Initial And Annual Expatriation Statement

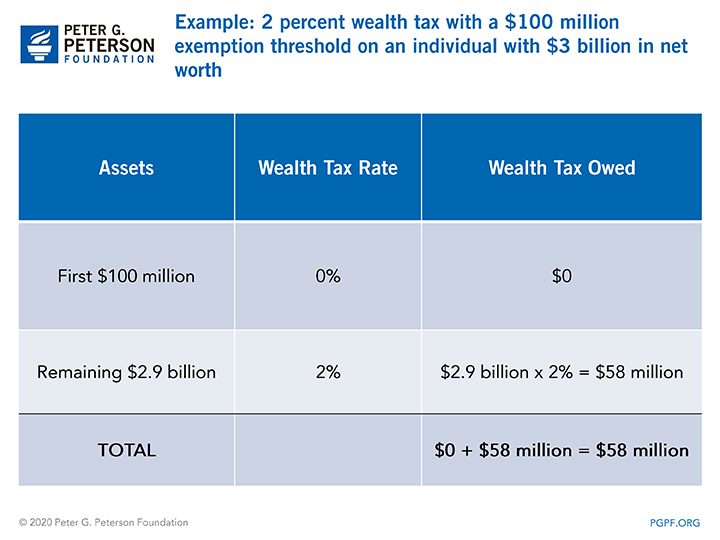

What Is A Wealth Tax And Should The United States Have One

Exit Tax In The Us Everything You Need To Know If You Re Moving

What Is Form 8854 The Initial And Annual Expatriation Statement